Get the free drs form ct 941 hhe 2015

Show details

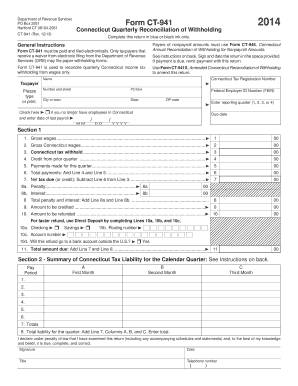

Department of Revenue Services State of Connecticut PO Box 2931 Hartford CT 06104-2931 (Rev.12/12) Form CT-941 THE 2012 Connecticut Reconciliation of Withholding for Household Employers General Instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your drs form ct 941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your drs form ct 941 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit drs form ct 941 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit drs form ct 941. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out drs form ct 941

How to fill out drs form ct 941:

01

Obtain a copy of the drs form ct 941 from the Department of Revenue Services (DRS) website or local tax office.

02

Start by providing your business and contact information, including your name, address, and employer identification number (EIN).

03

Indicate the tax period for which you are filing the form, typically either a quarter or an annual period.

04

Fill out the appropriate sections related to wages, withholdings, and Connecticut income tax owed.

05

If you have employees, report their wages and withholding amounts in the applicable sections.

06

Calculate your total Connecticut income tax liability based on the provided instructions and tables.

07

Deduct any prepayments, credits, or other adjustments that may apply to your tax liability.

08

Calculate the balance due or refund owed and enter the amount in the appropriate section.

09

Sign and date the form.

10

Keep a copy of the completed form for your records.

Who needs drs form ct 941:

01

Employers who have employees and are required to withhold Connecticut income tax from their wages.

02

Businesses with a Connecticut income tax liability for either a quarterly or annual period.

03

Those who have received a request or notification from the Department of Revenue Services to file the drs form ct 941.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is drs form ct 941?

The DRS Form CT-941 is a quarterly reconciliation of withholding for the State of Connecticut, used by employers to report their payroll tax withholding. This form is used to reconcile the amount of state income tax withheld from employee wages and the amount of taxes deposited with the Connecticut Department of Revenue Services (DRS). It is important for employers to accurately complete and submit this form to ensure that they are in compliance with state tax regulations.

Who is required to file drs form ct 941?

Any employer who is required to withhold Connecticut income tax from employee wages is required to file form CT-941, also known as the Connecticut Quarterly Reconciliation of Withholding.

How to fill out drs form ct 941?

To fill out the CT-941 form, also known as the Connecticut Quarterly Reconciliation of Withholding, follow these steps:

1. Download the Form: Visit the official website of the Connecticut Department of Revenue Services (DRS) and search for the CT-941 form. Download and save the form to your computer.

2. Enter Business Information: Provide your business's name, address, and federal employer identification number at the top of the form.

3. Account Number: If you have a Connecticut Withholding account number, enter it in the designated field.

4. Quarter and Due Date: Indicate the quarter and year for which you are filing the form. The due date for CT-941 is the last day of the month following the end of each quarter.

5. Employee and Wage Information: Make a list of all your employees and report their names, Social Security numbers, wages, tips, and other compensation received during the quarter. Include any tax withheld from these wages.

6. Total Withholding Tax: Calculate the total amount of Connecticut income tax withheld from your employees' wages during the quarter. Transfer this amount to the corresponding field on the form.

7. Total Payments: Add up all the payments made during the quarter, including the tax withheld, and enter the total in the appropriate section.

8. Calculate Withholding Tax Liability: Subtract the total payments from the total withholding tax to determine if you owe any additional taxes or if you have overpaid. Make sure to review the instructions provided with the form to ensure the correct calculations.

9. Authorization: Sign and date the form where indicated.

10. Submit the Form: Send the completed CT-941 form along with any payments due to the Connecticut Department of Revenue Services. Make sure to retain a copy for your records.

It is recommended that you consult the CT-941 instructions, available on the DRS website, for more detailed guidelines and information on any specific requirements or changes to the form.

What is the purpose of drs form ct 941?

The purpose of the DRS Form CT 941 is to report and pay Connecticut Quarterly Reconciliation of Withholding taxes. This form is used by employers in Connecticut to reconcile the amount of state income tax withheld from their employees' wages and the total amount of state income tax due. It is filed on a quarterly basis and provides important information to the Connecticut Department of Revenue Services (DRS) for tax purposes.

What information must be reported on drs form ct 941?

Form CT-941, Employer's Quarterly Reconciliation of Withholding, is used by employers in the state of Connecticut to report the wages paid and the state income tax withheld from employees' paychecks. The following information must be reported on this form:

1. Employer Information:

- Employer's name, address, and federal employer identification number (FEIN)

- Contact person's name, phone number, and email address

2. Employee Information:

- Total number of employees (including both full-time and part-time)

- Total wages paid to employees during the quarter

- Total amount of state income tax withheld from employees' paychecks

3. Withholding Information:

- Total Connecticut income tax withheld during the quarter

- Total amount of overpayment from the previous quarter (if any)

- Total amount due (if any)

4. Payment Information:

- Total tax payments made during the quarter (including electronically filed payments)

- Total amount of any penalty or interest due (if applicable)

5. Certification:

- Employer's signature, date, and title

It's important to accurately report all the required information on Form CT-941 to ensure compliance with Connecticut state tax regulations. Additionally, employers must file this form quarterly (by April 30, July 31, October 31, and January 31) to reconcile the amount of withheld state income tax with the tax liability for that quarter.

What is the penalty for the late filing of drs form ct 941?

The penalty for the late filing of CT-941, also known as the Connecticut Quarterly Reconciliation of Withholding, ranges from $50 to $500 depending on the number of times the filing is late within a 24-month period. The penalty amounts are as follows:

- First late filing within a 24-month period: $50

- Second late filing within a 24-month period: $100

- Third late filing within a 24-month period: $200

- Fourth or subsequent late filing within a 24-month period: $500

Additionally, interest may be charged on the unpaid tax amount. It is important to file the CT-941 form on time to avoid penalties and interest.

When is the deadline to file drs form ct 941 in 2023?

The deadline to file Form CT-941 in Connecticut is the last day of the month following the end of each calendar quarter. Therefore, the deadline for filing Form CT-941 in 2023 would depend on the specific calendar quarter. Here are the deadlines for each quarter in 2023:

- Quarter 1 (January 1 - March 31, 2023): April 30, 2023

- Quarter 2 (April 1 - June 30, 2023): July 31, 2023

- Quarter 3 (July 1 - September 30, 2023): October 31, 2023

- Quarter 4 (October 1 - December 31, 2023): January 31, 2024

Please note that these deadlines may change, so it is always recommended to verify with the Connecticut Department of Revenue Services or consult a tax professional for the most accurate and up-to-date information.

How can I get drs form ct 941?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the drs form ct 941 in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit drs form ct 941 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing drs form ct 941 right away.

How do I fill out drs form ct 941 on an Android device?

Use the pdfFiller mobile app to complete your drs form ct 941 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your drs form ct 941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.